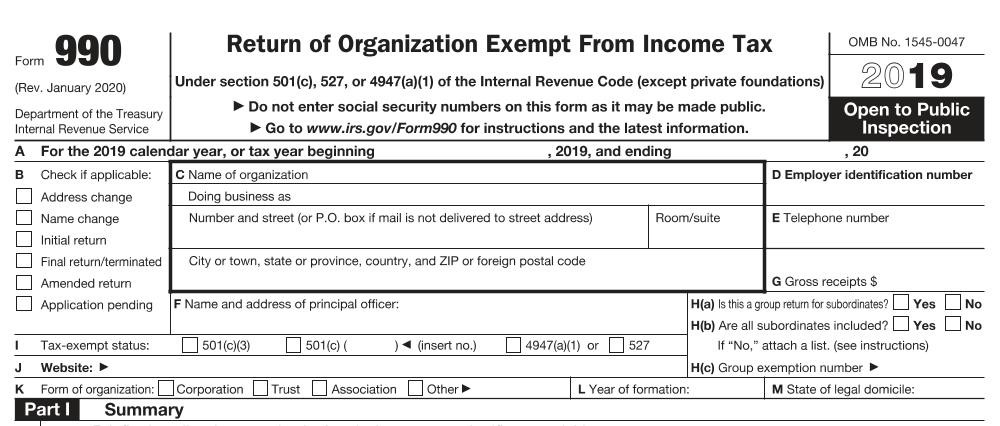

2024 Form 990 Schedule And Fees – One of the most commonly used schedules that organizations use to provide supplemental information to Form 990 is Schedule O. All pages of Form 990 are available on the IRS website. Special . Only available to the smallest of non-profit organizations, Form 990-N is the simplest form of tax reporting for tax-exempt groups. Organizations with usual receipts of $50,000 or less file Form .

2024 Form 990 Schedule And Fees

Source : www.linkedin.comBoys Buffalo Challenge Greater Buffalo Gymnastics Center

Source : www.greaterbuffalogymnastics.comForm 990: Return of Organization Exempt from Income Tax Overview

Source : www.investopedia.comCrysta Tyus, EA

Source : www.facebook.comIntermediate Guide to Reading Form 990 (April 24, 2024)

Source : johnsoncenter.orgUnderstanding the IRS Form 990 Foundation Group®

Source : www.501c3.orgBeginner’s Guide to Reading Form 990 (March 19, 2024)

Source : johnsoncenter.orgSouthern Hills Riding Academy | Okemah OK

Source : www.facebook.comPaul J. Lapointe on X: “The Soccer Hall of Fame sits on MLS owned

Source : twitter.comWomen Veterans Engage Form Women Veterans Alliance

Source : www.womenveteransalliance.com2024 Form 990 Schedule And Fees Dr. Ivy Beckham, CPA, EA posted on LinkedIn: You’ll be asked to sign into your Forbes account. Form 990 is a required filing that creates significant transparency for exempt organizations. In 1971, it was harder to get your hands on a Form . And depending on the type of organization you are forming, you will also need to fill out one of the attached schedules (e.g., Schedule The IRS Form 1023 filing fee is $600. .

]]>

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png)